Krit Chanwong and Scott Lincicome

In a new Cato policy analysis out today, September 19, we show that state and local corporate subsidies have increased substantially in recent years, even though their economic costs typically exceed any plausible regional benefits. The paper finds, among other things, that the growth of these corporate incentives is likely owed to their enduring political attractiveness and to new federal industrial policy initiatives. It also finds that state and local subsidies routinely create problems beyond their high budgetary (taxpayer) expense.

Ohio’s latest subsidies to US chipmaker Intel may unfortunately provide us with yet another example.

As Scott Lincicome explained in a recent op-ed, Intel was just awarded the largest federal subsidy package under the 2022 CHIPS and Science Act (up to $44.5 billion in grants, loans, and tax credits), even though the company faces financial and strategic headwinds that have been building for decades. Key to Intel’s federal subsidy award was its promised construction of a huge chip facility in New Albany, Ohio, which has received further financial support from state and local governments, including:

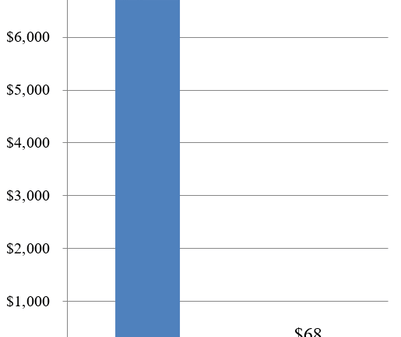

- A $1.941 billion subsidy from Ohio’s state government. These include $600 million in grants and $650 million in tax incentives over thirty years. This is the largest incentive package in Ohio’s history and represents almost seven percent of the state’s general fund revenue in 2022–2023.

- A 100 percent property tax abatement over thirty years from the New Albany local government.

As is often the case, Intel’s Ohio plans were announced to much fanfare in Washington, DC, and Ohio, even though the subsidies’ expected returns were immediately suspect. Intel promised, for example, that the New Albany project would generate 3,000 Intel jobs, 7,000 construction jobs, and “tens of thousands of additional jobs with suppliers and partners.” This would mean, however, that – even under the rosiest of projections – governments were paying at least $1.94 million for each job directly created by the New Albany facilities. And this assumes, of course, that Intel’s plans fully materialize.

There are already reasons to doubt that they will. As of 2023, Intel only employed 69 people in Ohio, and the firm has delayed the opening of its first New Albany plant from 2025 to 2026, with full operations supposedly starting in 2027. The company is also contemplating scaling back the scope of its factory investments in Ohio and elsewhere. Since many of the state and local subsidies to Intel can’t be clawed back, Ohio taxpayers could end up with an even worse deal than the bad one their elected officials signed them up for in the first place.

Some officials are expressing anxieties about Intel’s future in New Albany and in the process are demonstrating some of the corporate incentives’ political realities. For example, Licking County Commissioner Tim Bubb admitted that he and his fellow government officials were “overly optimistic” and didn’t do their due diligence when offering Intel all this taxpayer money. They simply “knew the name Intel.” Today, meanwhile, Bubb shows the political and practical difficulty of unwinding subsidy packages once offered: “We’re somewhat at their mercy. They own the site.” And he now admits that delays to the construction “could have somewhat of a cooling effect on the land speculation market” caused by the subsidies, thus adding to the possible economic pain in the area should Intel’s promises not pan out.

As we explain in our paper, these and other “unseen” costs are difficult to quantify and usually ignored, but they help to explain why so many economists warn against state and local business subsidies. Time and time again, the incentives’ direct and indirect costs are substantial, and there is little evidence that they generate broader economic spillovers—economic growth, job creation, increasing productivity, etc.—that might justify such an expense. The measures thus persist not for economic reasons but political ones, namely because politicians find them irresistible. Our paper suggests some guardrails to temper these political incentives and to help state and local legislators pursue pro-growth policies that don’t rely on costly corporate handouts like the ones Ohio and Licking County gave to Intel.

That deal might not be fixable, but perhaps its lessons and our reforms can help to prevent future ones like it.