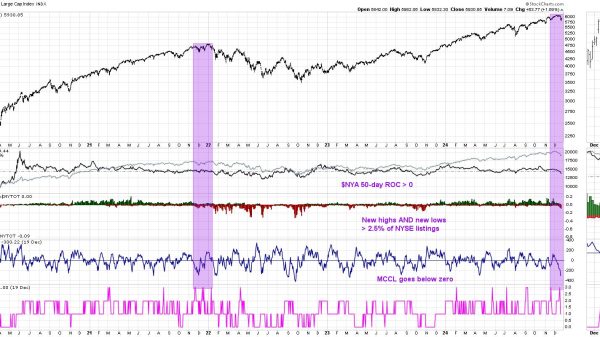

The “Magnificent 7”, comprised of Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Meta Platforms (META), Amazon.com (AMZN), Alphabet (GOOGL), and Tesla (TSLA) have carried the S&P 500 during this secular bull market – since its breakout in April 2013 above its 2000 and 2007 highs. Here’s a weekly chart of the S&P 500 during this secular bull market, with 7 price panels below, each highlighting the relative strength of one of the Mag 7 stocks:

These Mag 7 stocks have seen their market caps EXPLODE during this bull market and they’ve become a larger and larger representation of the S&P 500 as a result, because the S&P 500 is a market-cap weighted index.

Heading into their next earnings reports, however, I only see 3 of these 7 stocks showing solid relative strength vs. its peers – AAPL, NVDA and META. In my opinion, NVDA is the strongest and is likely to have a very strong run higher into its November 20th quarterly earnings report. Check out its excellent relative strength and rising AD line:

It’s hard to find something not to like about NVDA’s chart. The AD line has continued to climb, even while its price was consolidating/declining. Relative strength has done the same. The overall market must face the worst week of the year historically this upcoming week, but otherwise, the coast is clear for yet another breakout on NVDA.

During my weekly market recap, “Which Mag 7 Stocks Should YOU Own?”, I discuss the charts of all Mag 7 stocks, along with an overview of last week’s stock market action. I showed a few interesting RRG charts to easily visualize strong areas of the market. Be sure to check out the video by clicking on the link above. Also, I’d really appreciate you hitting the “Like” button and the “Subscribe” button, as we build out our YouTube community. Thank you so much!

Relative Strength

I cannot overemphasize the importance of relative strength, especially when it comes to quarterly earnings reports. Wall Street talks to company management teams throughout the quarter and gets a strong sense of which companies are executing their plans flawlessly and which companies aren’t. This shows up in their stock price and how they perform relative to their industry peers. I’d struggle to trade during earnings season without this one very critical piece of technical information.

Intuitive Surgical (ISRG) is an example of a stock showing excellent leadership among its peers. When its quarterly earnings absolutely blew away estimates, I was not surprised at all. The big Wall Street firms have been accumulating ISRG for months and months and clearly showing on the chart that ISRG was the best of breed. Check out ISRG’s relative strength and AD line heading into earnings…..and then its earnings reaction on Friday:

On the heels of beating both revenue and earnings estimates, ISRG jumped to a new all-time high. Owning stocks like ISRG will help you outperform the S&P 500 and will also help you meet your financial goals.

On Monday, I’ll be providing one of the best stocks, in terms of relative strength, that will be reporting in the week ahead. Simply SIGN UP for our FREE EB Digest newsletter (no credit card required) and we’ll send this chart to you first thing Monday morning!

Happy trading!

Tom