Eric Gomez and Benjamin Giltner

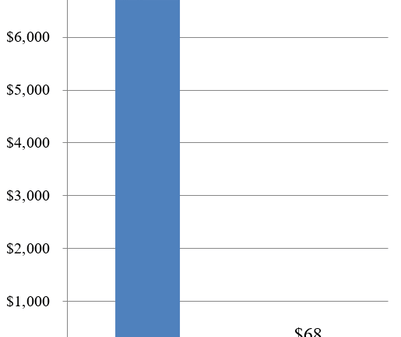

August 2024 was a very active month for arms sales with 22 new Foreign Military Sales (FMS) cases announced. However, the Taiwan arms sales backlog was unchanged from last month with no new sales announced or deliveries completed. Taiwan is waiting for $20.5 billion of US weapons. Although none of the new FMS cases directly affect the Taiwan arms backlog, it is worth taking a look at how these sales overlap with the sales that Taiwan is awaiting.

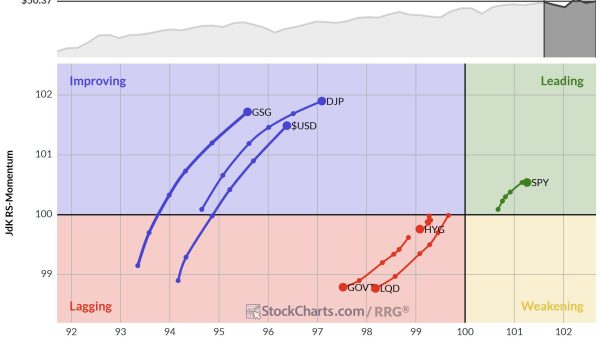

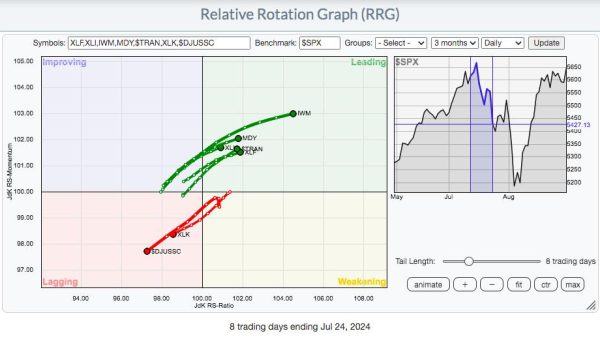

Figures 1 and 2 show how the backlog is divided between munitions, asymmetric capabilities, and traditional capabilities. Table 1 shows an itemized list of backlogged capabilities.

According to the Defense Security Cooperation Agency’s archive of major arms sales announcements, which goes back to April 2008, August 2024 was the busiest month for new FMS cases. Of the 22 sales announcements, 10 overlap with the Taiwan backlog. Table 2 shows all the August 2024 sales, with check marks indicating sales that overlap with capabilities that have been sold but not delivered to Taiwan. The dollar value of the 22 August FMS cases comes to $32.6 billion.

The United States has seen a significant increase in FMS cases since Russia invaded Ukraine in February 2022. According to the Department of Defense, “In fiscal year 2023, the US did more than $80 billion in business through the foreign military sales system. That is a record.” In fiscal year 2022 this figure was $51.9 billion. Conflicts in Europe and the Middle East and growing concerns about China’s military power are prompting this rapid increase in FMS. Foreign countries want to buy US weapons, and Washington is happy to oblige.

However, surging demand for US weapons may not be good news for Taiwan, at least not immediately. The US defense industrial base has started increasing its production capacity across many highly sought-after weapons. But it will be several years until these expansions are complete. Demand for US weapons currently outpaces supply, and this will remain the case until the late 2020s for several key capabilities.

Taiwan has already had to deal with the effects of this supply-and-demand mismatch. In 2022, Taipei cancelled a purchase of Paladin self-propelled howitzers due to production delays. Taiwan has also contended with delays for deliveries of TOW-2B anti-tank missiles and Stinger anti-aircraft missiles, both of which have been sent to Ukraine in large numbers.

The United States has used different legal mechanisms for providing weapons to Ukraine, and weapons sent to Ukraine do not necessarily or automatically lead to Taiwan arms delays. However, the defense industrial base must simultaneously replenish US stockpiles and fulfill new FMS cases while also supplying regular US military demand, and a growing number of new FMS cases are for weapons that haven’t been delivered to Taiwan yet. Taiwan should start receiving several large arms packages in the next one to two years. However, these timelines could slip given the competing demands on the US defense industrial base that are exacerbated by a record-high FMS caseload.

Ultimately, the pace of US weapons deliveries to Taiwan, especially before expanded industrial supply can catch up with increased demand, will be a useful tool to measure US foreign policy priorities. If moving Taiwan toward an asymmetric self-defense strategy is indeed a top US priority, then Taiwan should not see delays for high-demand capabilities, especially in FMS cases announced before the 2022 surge of new cases. Unfortunately, Taiwan’s recent experience suggests that it does not enjoy such pride of place.