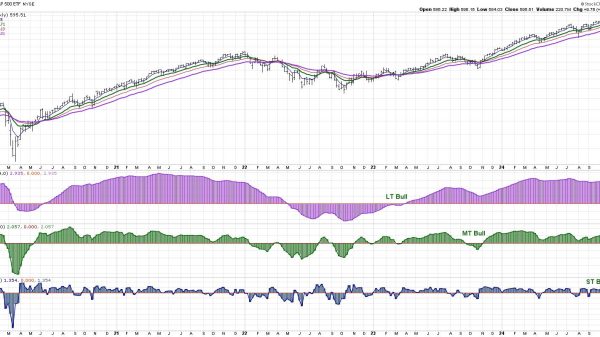

As the secular bull market takes a short-term pause, now is the time to research tremendous opportunities that lie ahead. I’ve looked at more than a thousand charts and wanted to point out 3 in particular that I see heading much, much higher as we close out 2024 and move into a brand new year. There are tons of companies that have been regularly setting 52-week and all-time highs. Most of those are very overbought and carry more short-term risk. I want to instead focus on stocks that have been basing for an extended period of time and have just made a breakout.

Stock 1 – Amazon.com (AMZN)

I love this breakout. We’ve actually had two breakouts. The first was the move above the 190 area, stopping at 200. Then more recently, AMZN cleared 200 before profit taking kicked in this past week with options expiration. We’re now back close to that 200 support level. Here’s the 10-year weekly chart:

The current setup looks eerily similar to the setup heading into 2020. I trust this current breakout, considering that AMZN’s top in 2021 started a lengthy consolidation/basing period – similar to a cup formation. If we use that cup as a measurement stick for the potential rally ahead in AMZN shares, we’d be looking at 320. I’d take that 60% gain.

Stock 2 – Fortinet, Inc. (FTNT)

FTNT is another stock that has an excellent long-term track record, but struggled during a lengthy consolidation/basing period since late-2021:

It’s important to point out that software ($DJUSSW) just broke out and it’s been the 3rd best industry group since the current secular bull market was confirmed in April 2013, rising 774% over the past 11 1/2 years. The only two industry groups stronger have been computer hardware ($DJUSCR, +1019%) and semiconductors ($DJUSSC, +1488%). This compares to a 266% jump in the S&P 500. I’ll take a leading stock in a leading industry group, both of which are breaking out, ANY TIME.

Stock 3 – Home Depot, Inc. (HD)

Yep, that’s 2 out of 3 Dow Jones component stocks, joining AMZN. I love the breakout here. The patterns don’t get any nicer and more bullish than this one. HD topped in late-2021, just like both AMZN and FTNT, before proceeding to print a beautiful, symmetrical, rounded cup:

I see HD having a strong finish to 2024 and a very solid 2025. Throw in HD’s 2.2% dividend yield, a dividend that’s risen every year since the turn of the century, and I believe there are the makings of a “super stock” in the years ahead. Steady grower with rising income to boot! Yes please!

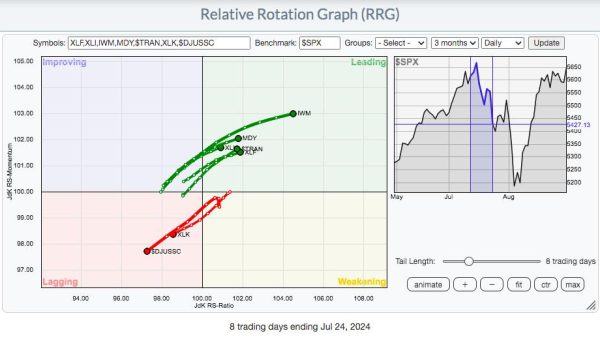

I see the Dow Jones Industrial Average being very strong for the foreseeable future, partly due to the AMZN and HD outlooks, but I still favor small- and mid-caps BIG TIME. I’m hosting a webinar later this morning at 11:00am ET, “Capitalizing on Small- and Mid-Cap Strength”. It’s completely free (no credit card required) to the public, but you do need to register for the event. You can follow the link to do so and to learn more information about the event. If you can’t make the 11am webinar, absolutely no worries. All of those who register will gain access to the recording, including those registering after the event has ended. So be sure to REGISTER NOW to find out why small and mid caps are poised to EXPLODE!

Also, my latest Weekly Market Recap video, “Monthly Options and Negative Divergences Hammer the Bulls!” has been published on YouTube. You can watch it HERE.

Happy trading!

Tom